Money plays an important role in our lives, influencing many of our daily decisions and interactions. We each have unique mindsets and habits when it comes to giving and spending. In this section, we’ll explore the character traits and attitudes that shape our approach to generosity and financial decisions.

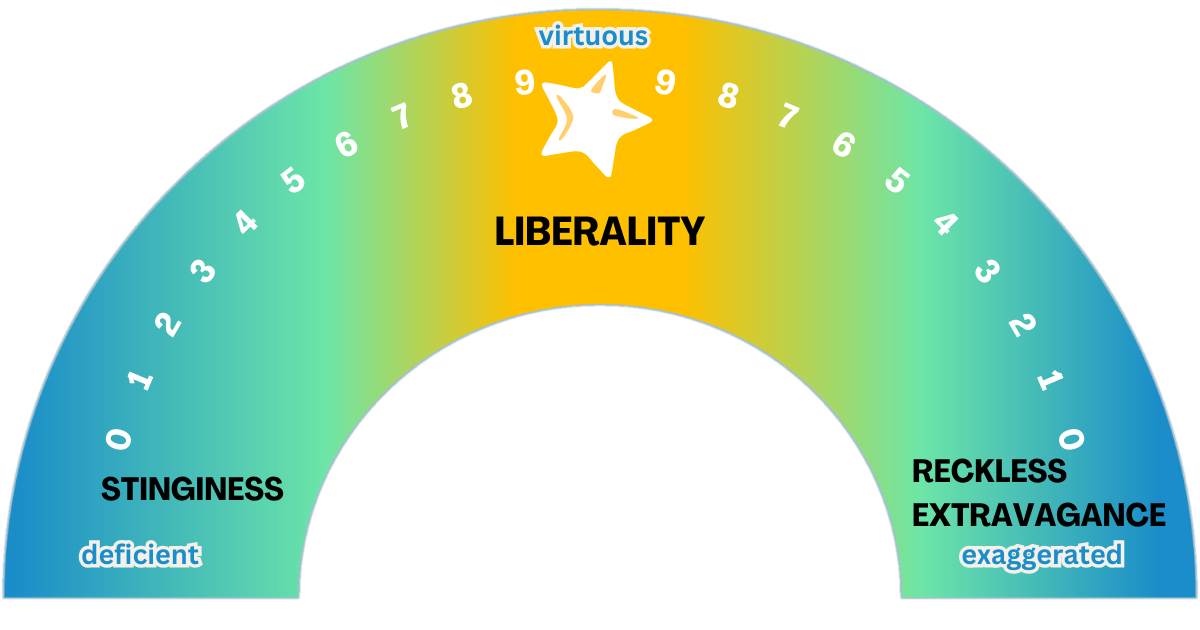

The Continuum

Along the continuum of giving and spending, individuals can fall at various points. On one extreme is stinginess, characterized by an unwillingness to part with resources. On the other extreme is reckless extravagance, marked by excessive and imprudent spending. The virtuous path lies in the center, where balance and moderation are found.

People may find themselves at various positions on this continuum. To make things even more complex, some may shift their position based on the circumstance. For instance, someone might be very stingy with themselves but more generous when giving gifts to others.

Stinginess: At this end of the spectrum, individuals exhibit a reluctance to give or spend on themselves or others, often being tight-fisted and unwilling to part with their money, even for things that will really enhance their lives or make their life easier or more comfortable.

Cautious Spending: Progressing, individuals adopt an overly cautious approach to giving and spending, often overthinking their purchases but occasionally spending some money, even if somewhat begrudgingly.

Liberality/Generosity: As the median, individuals demonstrate a willingness to give freely, reflecting an open and expansive mindset without excessively restricting oneself or indulging in extravagance.

Occasional Splurging: Advancing along the spectrum, individuals may occasionally indulge in bouts of extravagant spending without considering the consequences.

Reckless Extravagance: At the extreme end of the continuum, individuals exhibit a disregard for financial prudence, engaging in reckless spending and extravagant behaviors without restraint.

Benefits of Balanced Liberality and Generosity

When we live according to the median, maintaining a balanced sense of liberality and generosity, our lives become richer and more fulfilling. This balanced approach to giving and spending not only enhances our well-being but also positively impacts those around us.

Here are some benefits:

Overall Wellbeing. Liberality and generosity often leads to feelings of happiness and fulfillment. Helping others can boost your mood and overall emotional well-being.

Reduced Stress. Financial responsibility reduces stress related to money, such as debt anxiety or financial instability.

Stronger Relationships. Generosity can strengthen relationships with family, friends, and colleagues. People appreciate and remember acts of kindness. Being generous can help build a network of supportive and like-minded individuals.

Positive Impact on Others. Generous acts contribute to the well-being of your community, helping those in need and supporting local causes.

Lasting Happiness. Investing in meaningful activities and relationships often leads to lasting happiness, compared to the short-lived pleasure of impulsive purchases.